Self-employed, freelancer, consultant, entrepreneur or running a small business ? Unsure how to do your invoicing online ? Stay right there, Kiwili has the answers for doing your invoices online simply and free of charge as well as all the essentials you’ll need to include.

Create An Invoice Free Of Charge In 4 Simple Steps

Step 1 : The following information must be included on an invoice

- Invoice number: this must be unique, we recommend choosing 6 digits and then adding 1 for each new invoice or modification, this gives you a numbering system which is practically infinite

- You’ll need to use the word “invoice” somewhere on the document, whether that’s as a heading, header, footer, or in the body of the text

- Details of the product(s) or service(s) you provided, the more detail this section has, the less chance there is for any misunderstandings or miscommunication between you and your client

- A breakdown of the quantity of products, days, hours, pages, or other unit of measurement used by your industry

Step 2 : The following dates must be included on an invoice

- Date the invoice was sent, this is essential

- Date products were purchased or services completed

- Date the invoice is due or period of time available for making the payment, eg. “to be paid before the MM/DD/YYYY or within 14 days”

Step 3 : The following contact details and identifying information must be included on an invoice

- Name and address of customer or client, you can also add in any other relevant ID information such as phone number, email address, website, etc. this means you can get back in touch with the client quickly if necessary

- Name and address of supplier, it’s a good idea to add any relevant information for the client here too

- Reference number/ tax identification number

- Delivery/shipping address

Step 4 : The following pricing and tax information must be included on an invoice

- Tax identification number

- Price of products, services, or hourly rate, excluding tax

- Amount of tax

- Any possible additional expenses such as transport costs, packaging, late fees, etc.

- Any possible deductions such as discounts, rebates, or reductions

- Final charge including taxes

Tax identification numbers vary from country to country. The following terms might help you out:

- US: Tax Identification Number (TIN)

- Canada: Canadian Social Insurance Number (SIN) and Business Number (BN)

- Québec: Québec Enterprise Number (NEQ)

- UK: Unique Taxpayer Reference (UTR) and National Insurance Number (NINO)

- France: SIREN or SIRET

Tax in Canada, and especially Québec, can be complex. In Canada, the basic tax rate for businesses is 38%, which drops to 28% with the federal tax abatement and 15% after the tax reductions in Québec. For SMEs, there is something called a DPE, which is a deduction bringing the tax rate down to 10.5%, depending on what sector the company is in and its income. The DPE is a huge asset for SME’s however there are some requirements to meet in order to qualify. For starters, only Canadian-owned private entities are applicable.

Whether you’re a micro-business or self-employed and no matter where you are in the world, the core elements of an invoice remain the same. For more information, you could do some research on the legalities of invoicing in your country or, simply sign up for a free trial with Kiwili today and start generating invoices online with our software in minutes.

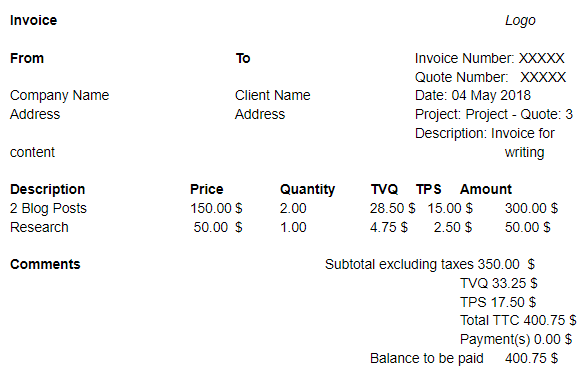

Invoice Template :

Note that on this example invoice, we’ve added on the taxes that are applicable in Québec.

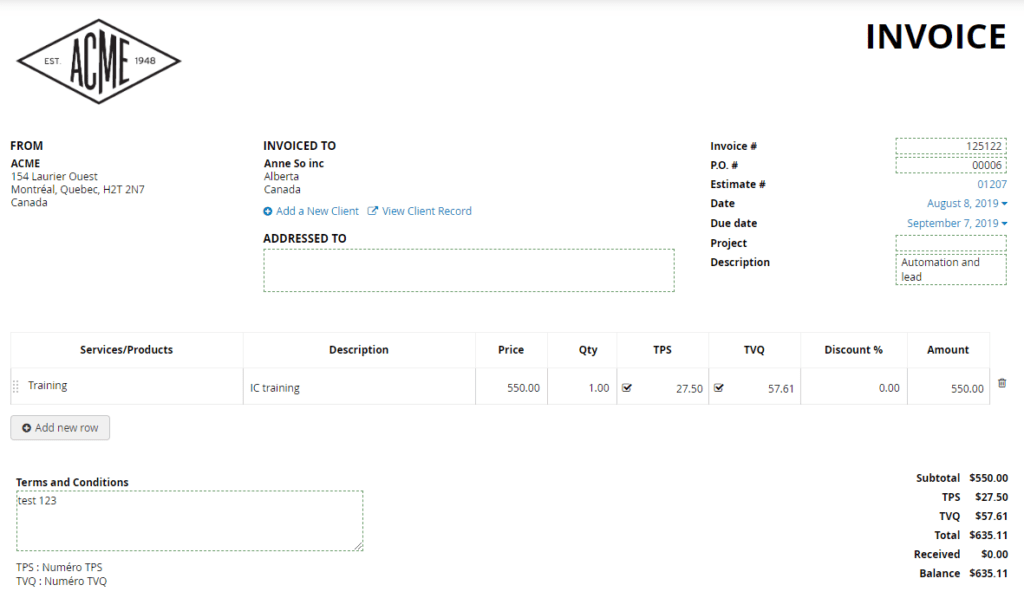

Even easier : Use Kiwili to generate invoices automatically

Kiwili’s invoice functionality will allow you to adjust the settings to apply the taxes due in your area.

Note that on this Kiwili example invoice, we’ve added on the taxes that are applicable in Québec.

Kiwili is an accounting management software featuring invoicing and estimation functionality designed specifically with entrepreneurs in mind, the all-in-one solution will save you from spending hours on Excel creating invoices manually. In no time at all, you’ll be not only creating invoices online, but also sending them straight to the client and getting paid directly through Stripe or PayPal. Try out our customizable software selecting the features that suit you best and you’ll see how simple things can be with Kiwili. What’s more, using an invoicing software like Kiwili stores your data securely and saves you time!

Here are some features that you’ll find on your Kiwili dashboard, which will help you do your invoicing easily:

- Identification: your details and those of your clients are saved in the software, all you have to do is select the client you want to invoice

- The invoice number is generated and assigned automatically

- The date is filled in too, but you can modify it easily if needed

- Taxes are calculated automatically, you choose whether to apply them or not, the price excluding taxes and TTC is updated automatically too

- If you are billing your client in hours, you can import your hours logged from different projects directly

- You can add any additional desired information to the invoice: description, delivery date, payment date

Now you know how to create an invoice online simply and free of charge using Kiwili’s ERP, the rest is up to you! Create a personalized invoice, send it straight to your client, and get paid online. In the event that your client doesn’t pay their invoice on time, you’ll need to send a reminder message. Feel free to check out our guide for more detail on how to deal with late payments here

Sign up for Kiwili today for the best all-in-one management software for entrepreneurs and SME’s, and simplify the day-to-day management of your business.

Kiwili is an all-in-one business management software. It is at the same time an easy invoicing software, an accounting software, a CRM, a convenient project management tool and a time tracking software. Everything you need to manage your business like a pro!