Kiwili’s online accounting and management software will be your best ally when the time comes for doing your taxes. With Kiwili, you can quickly figure out the amounts you’ll need to declare for your tax return. In this post, we share our inside knowledge for calculating your gross income, expenses, and net income.

Declare Turnover, Gross Income, Fees and Services with Ease

As a freelancer, entrepreneur or business you need to keep on top of your figures and income for the financial year. When the time comes to file your tax return at the end of the year, Kiwili is here to help. In today’s post, we’ll look at some examples of the types of income you could have to declare on your tax return.

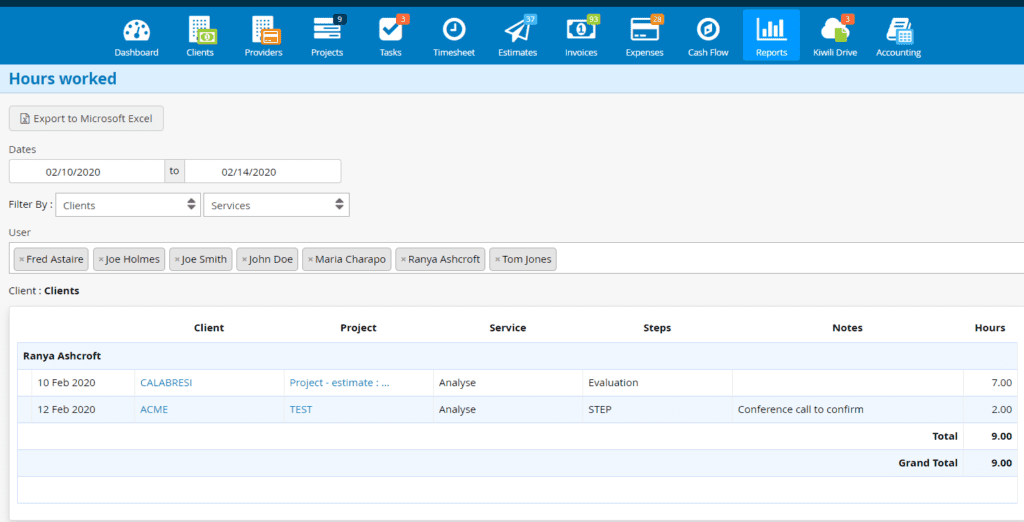

Like a majority of freelancers, your main source of income is your fees. Kiwili’s software allows you to charge by time spent working on a project. You can access data on your working hours, hourly rate, client, billing date, the corresponding project, and anything else you consider to be relevant, updated in real time. The report tab will help you with your tax return.

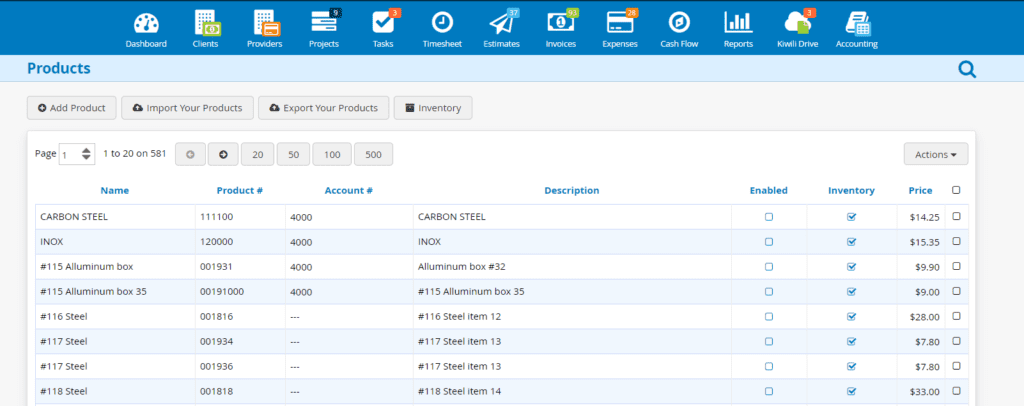

If you are a retailer or you sell products, your turnover will consist primarily of income from your sales. To help with your tax return at the end of the year, Kiwili recommends that traders monitor the sales of their various products. To see your income to be declared, you can view the sales reports by product.

For small service providers, it’s the sum of your invoices that will form the majority of your income. With Kiwili, invoicing and receiving payments is made easy. You can also calculate the difference between invoices paid and invoices sent.

To make it easier for freelancers,entrepreneurs and businesses to declare their taxes at the end of the year, the easiest solution is using Kiwili as your management and accounting software. With Kiwili, you can access figures for your turnover, fees and invoices with ease.

Manage Your Expenses With Simplicity

One of the advantages of being self-employed is being able to make some deductions to your tax bill to help offset your expenses.

Here are a few important points to help you when declaring your expenses:

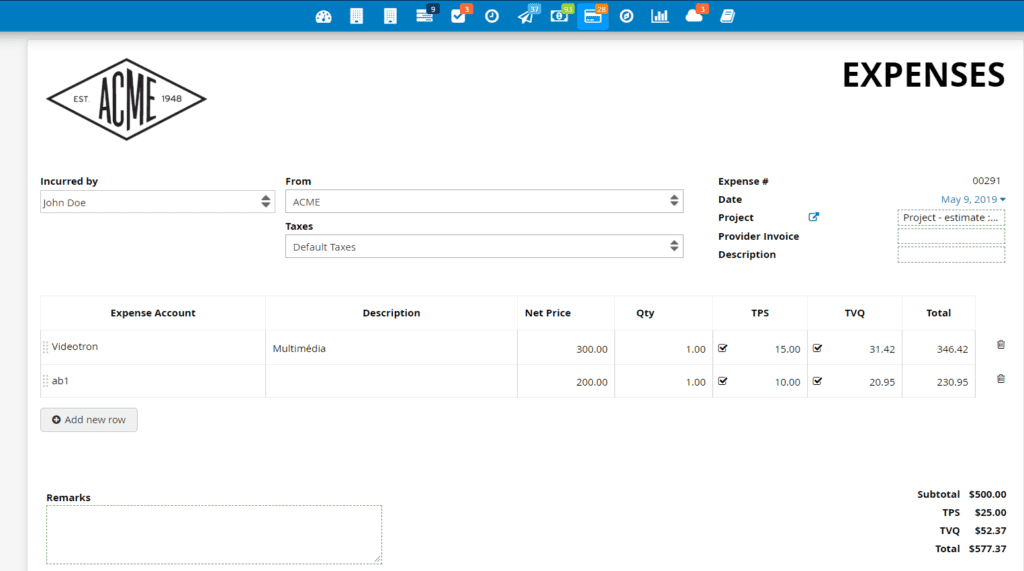

All of the charges to be deducted must occur within the same financial year. With Kiwili, you can add your expenses gradually as you go along, so you can be sure you don’t miss any. Monitoring your outgoings by month or by year is clear and simple with the expense tool.

- You must store your receipts for several years: At Kiwili, we recommend saving them online to free up space in your office and keep them securely backed up. You can choose whether to take a photo of your supporting documents and attach the image to the expense entry or upload invoices directly. No more wrestling with battered old folders and scrawled receipts.

- Your receipts must include: supplier name and address, the object of the transaction, and any applicable taxes. When recording a new expense, you can add a short description to remind you of the details of the transaction.

- When declaring your fees, you need to include whether or not taxes are applicable. With our online accounting and management software Kiwili, you can choose whether or not to apply taxes for each expense. You can also enter your own percentages to choose from. This function is extremely useful, above all when the amount of tax varies depending on the category of product or service.

- A few more tips to streamline the process of filing your tax return at the end of the year. On top of simplifying the management of your expenses, our all-in-one tool will be invaluable if you are audited, as all of your information will be organized and easily accessible online from anywhere in one single location.

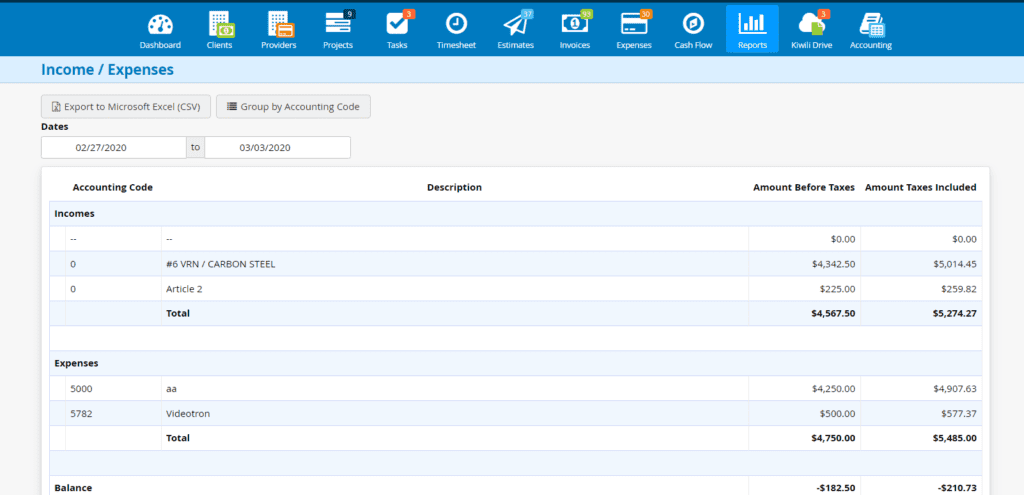

Your Tax Return: Net Income

And now, the key factor for any entrepreneur: the profit! Your profit is quite simply the difference between your income and your expenses. Now, as we all know, calculating your expenses can be tricky – that’s why Kiwili is here to help. Simply log in and check your Income/Expense Report.

Filing Your Tax Return As A Freelancer:

There are three options for declaring your end of year taxes.

1) Tax declaration by paper form

The most traditional way of declaring your taxes (but not necessarily the easiest), is the paper form provided by the government.

2) Tax declaration via online software

Declaring your taxes online is the simplest method with the fewest costs incurred. Utilize online software for calculating the amounts of income and expenses.

3) Tax declaration using a tax preparer

The last option is to enlist the help of a tax preparer. Make sure you verify that this person is fully competent before entrusting them with this important task.

Tax Declaration Forms

Taxes Québec

Taxes Canada

Income tax package (forms by province)

Taxes US

IRS Instructions for Schedule SE (2019)

Taxes UK

Now that we’ve shared our inside knowledge and you know the key figures required for declaring your taxes – it’s all down to you! For more reading on tax and company accounting, we recommend visiting our blog and checking out the following articles:

https://www.kiwili.com/Blog/post/create-invoices-online-4-easy-steps-with-examples/

And remember, don’t miss the deadline! When is the deadline for filing a tax return in your country? Mark it on your calendar today!

Kiwili is an all-in-one business management software. It is at the same time an easy invoicing software, an accounting software, a CRM, a convenient project management tool and a time tracking software. Everything you need to manage your business like a pro!